ADVANCE TAX RELIEF BLOG

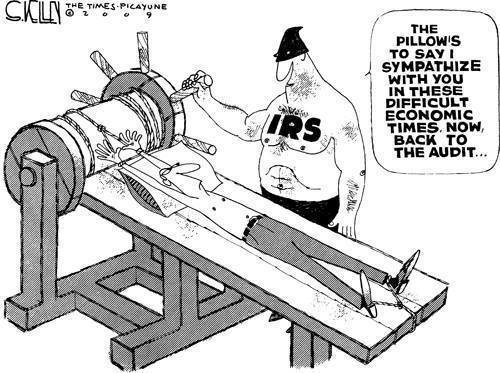

"My husband lost his job and the IRS was garnishing my wages. I called advance tax relief for help, my wage garnishment was released and we settled with the IRS for $1,200 on a $48k debt. Our family is very grateful" - Shirley W, Tampa FL.

RSS Feed

RSS Feed