The Child Tax Credit is a tax credit that may save taxpayers up to $1,000 for each eligible qualifying child. Taxpayers should make sure they qualify before they claim it. Advance Tax Relief - We Solve Tax Problems. Call (800)790-8574

0 Comments

Most people file a tax return because they have to. Even if a taxpayer doesn’t have to file, there are times they should. They may be eligible for a tax refund and not know it.

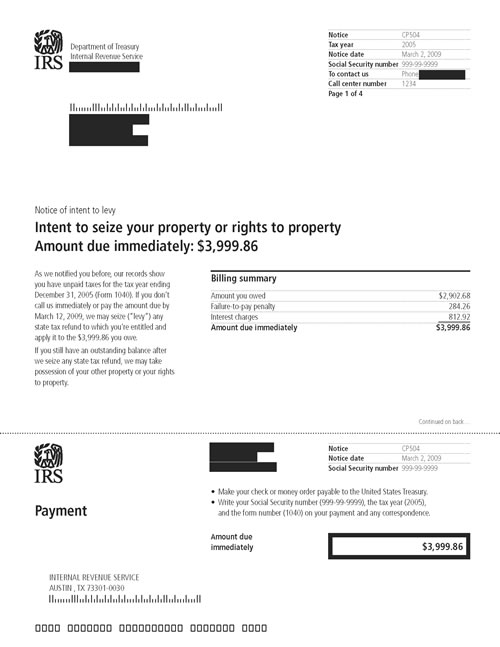

Here are five tips on whether to file a tax return: General Filing Rules. In most cases, income, filing status and age determine if a taxpayer must file a tax return. Other rules may apply if the taxpayer is self-employed or a dependent of another person. For example, if a taxpayer is single and under age 65, they must file if their income was at least $10,350. Tax Withheld or Paid. Did the taxpayer’s employer withhold federal income tax from their pay? Did the taxpayer make estimated tax payments? Did they overpay last year and have it applied to this year’s tax? If the answer is “yes” to any of these questions, they could be due a refund. They have to file a tax return to get it. Earned Income Tax Credit. A taxpayer who worked and earned less than $53,505 last year could receive the EITC as a tax refund. They must qualify and may do so with or without a qualifying child. They may be eligible for up to $6,269. Additional Child Tax Credit. Did the taxpayer have at least one child that qualifies for the Child Tax Credit? If they do not qualify for the full credit amount, they may be eligible for the Additional Child Tax Credit. American Opportunity Tax Credit. To claim the AOTC, the taxpayer, their spouse or their dependent must have been a student enrolled at least half time for one academic period to qualify. The credit is available for four years of post-secondary education. It can be worth up to $2,500 per eligible student. Even if the taxpayer doesn’t owe any taxes, they may still qualify. Complete Form 8863, Education Credits, and file it with the tax return. Get a free consultation from an experienced tax relief expert today (800)790-8574 or visit our www.advancetaxrelief.com Google: https://plus.google.com/+ADVANCETAXRELIEFLLCHouston BBB: https://www.bbb.org/houston/business-reviews/taxes-consultants-and-representatives/advance-tax-relief-llc-in-houston-tx-90024857/reviews-and-complaints A lot of IRS collection letters look the same, and those looks can often be very misleading. One of the biggest offenders is the IRS Notice of Intent to Levy IRS Notice CP504.

Direct Deposit is Easy, safe and fast. It is the best way to get a tax refund. Currently, 80% of taxpayers choose this option every year. The IRS knows taxpayers have a choice of how to receive their refunds.

|

Archives

June 2017

Categories |

"My husband lost his job and the IRS was garnishing my wages. I called advance tax relief for help, my wage garnishment was released and we settled with the IRS for $1,200 on a $48k debt. Our family is very grateful" - Shirley W, Tampa FL.

RSS Feed

RSS Feed