If you itemize your deductions for a taxable year on Form 1040, Schedule A (PDF), Itemized Deductions, you may be able to deduct expenses you paid that year for medical and dental care for yourself, your spouse, and your dependents. You may deduct only the amount of your total medical expenses that exceed 10% of your adjusted gross income or 7.5% if you or your spouse is 65 or older.

0 Comments

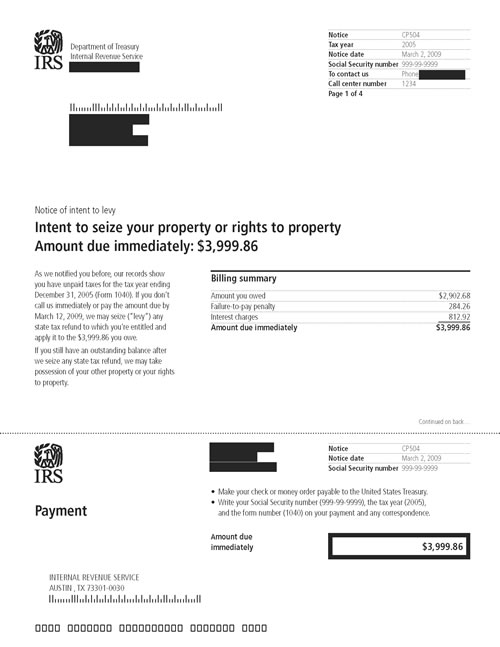

Since late 2015, the IRS has had the power to use passports to collect tax debts. H.R.22 added new section 7345 to an already bloated tax code. The new provision is titled “Revocation or Denial of Passport in Case of Certain Tax Delinquencies.”

That generally means if you owe more than $50,000 the IRS can't take your passport exactly, but it can tell the State Department to do so. Section 7345 of the tax code isn't limited to criminal tax cases, or even cases where the IRS thinks you are trying to flee. Recently, the IRS released new details on its website. If you have seriously delinquent tax debt, IRS can notify the State Department in a formal certification. The State Department generally will not issue or renew a passport after receiving a certification from the IRS. The IRS website will be updated from time to time about such notices. With the arrival of new IRS rules, it is worth considering how you might hold onto your passport even if you owe the IRS. A seriously delinquent tax debt is a key term. If you don’t have one, your passport is safe. So if you must owe, keep your debt below $50,000. But that includes penalties and interest, so beware. A $25,000 tax debt could eventually grow to $50,000. And be careful, once your tax debt is labeled 'seriously delinquent,' you paying it down to $49,999 may not help. The IRS will not reverse a certification because the taxpayer pays the debt below $50,000. What if the tax debt was your spouse’s, and you are saddled with it because of joint tax returns? You might qualify for innocent spouse treatment. This is a separate big topic, and rules are complex. However, it's significant that the IRS can suspend collection efforts if you request innocent spouse relief (under IRC Section 6015). In fact, there are many taxpayer protections when it comes to IRS collections. One set of protections is collection due process hearings. If you make a timely request for a collection due process hearing in connection with a levy to collect the debt, you may at least buy time to work out a deal with the IRS. Your problems have solutions – some are quick, some take longer than others and require more patience. It may be a weight to carry, but you are not dishonest for making mistakes to the IRS and with your taxes. You are only human. "According to IRS I owed IRS over $82k, Advance Tax Relief was very helpful and gave me the sense of relief that I will get pass this and I did. We Settled for $2500" - J Morris We are tax relief experts specializing in IRS back tax help, Installment Agreements, tax lien help, wage garnishment release, IRS Offer in Compromises and a whole lot more. Get a free consultation from an experienced tax relief expert today (800)790-8574 or visit www.advancetaxrelief.com https://plus.google.com/+ADVANCETAXRELIEFLLCHouston https://www.yelp.com/biz/advance-tax-relief-llc-houston https://twitter.com/IRSTAXPRO https://advancetaxreliefexperts.tumblr.com/ https://www.yellowpages.com/houston-tx/mip/advance-tax-relief-llc-505188847 Taxpayers who received unemployment benefits need to remember that it may be taxable. Here are five key facts about unemployment:

|

Archives

June 2017

Categories |

"My husband lost his job and the IRS was garnishing my wages. I called advance tax relief for help, my wage garnishment was released and we settled with the IRS for $1,200 on a $48k debt. Our family is very grateful" - Shirley W, Tampa FL.

RSS Feed

RSS Feed